Titan Machinery Fundamental Analysis

Disclaimer: This article by The Globetrotting Investor is general in nature. We aim to bring you long-term focused analysis driven by fundamental data, hence, providing you commentary based on historical data and analyst forecasts only using an unbiased methodology. This is not a buy/ sell recommendation, and it is solely for educational purposes. Please do your research before investing. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Please read the full disclaimer here.

Titan Machinery

Last Updated: 7 Nov 2023

NASDAQ: TITN

GICS Sector: Industrials

Sub-Industry: Industrial Distribution

Table of Contents

You can download a summary of Titan Machinery's fundamental analysis in PDF here.

Management

CEO: David Meyer

Tenure: 43.8 years

Titan Machinery Inc.'s management team has an average tenure of 8.3 years. It is considered experienced.

Source of Revenue

Titan Machinery Inc. and its subsidiaries own and operate a network of full-service agricultural and construction equipment stores in the United States and Europe. The company has been an authorized dealer of CNH Industrial N.V. or its U.S. subsidiaries since 1980.

CNH Industrial is a leading manufacturer and supplier of agricultural and construction equipment, which includes the Case IH Agriculture, New Holland Agriculture, Case Construction, and New Holland Construction brands.

In addition to the CNH Industrial brands, the company sells and services equipment made by a variety of other manufacturers.

Titan Machinery operates in three reportable segments: Agriculture, Construction, and International. Within each segment, the company engages in four principal business activities:

-

New and used equipment sales.

-

Parts sales.

-

Equipment repair and maintenance services.

-

Equipment rental and other activities.

New and Used Equipment Sales

Titan Machinery sells new agricultural and construction equipment manufactured under the CNH Industrial family of brands as well as equipment from a variety of other manufacturers. The used equipment the company sells is primarily acquired through trade-ins from its customers.

The agricultural equipment Titan Machinery sells and services includes machinery and attachments for uses ranging from large-scale farming to home and garden purposes.

The construction equipment Titan Machinery sells and services includes heavy construction machinery, light industrial machinery for commercial and residential construction, and road and highway construction machinery.

Parts Sales

Titan Machinery maintains an extensive in-house parts inventory to provide timely parts and repair and maintenance support to its customers. The company’s parts sales provide a relatively stable revenue stream that is less sensitive to economic cycles than its equipment sales.

Equipment Repair and Maintenance Services

Titan Machinery provides repair and maintenance services, including warranty repairs, for customers' equipment.

The company provides proactive and comprehensive customer service by maintaining service histories for each piece of equipment owned by their customers, maintaining 24/7 service hours in times of peak equipment usage, providing on-site repair services, scheduling off-season maintenance activities with customers, notifying customers of periodic service requirements, and providing training programs to customers to educate them on standard maintenance requirements.

Repair and maintenance services have historically provided a high-margin, relatively stable source of revenue through changing economic cycles.

Equipment Rental and Other Business Activities

Titan Machinery rents equipment to their customers, primarily in the Construction segment, for periods ranging from a few days to seasonal rentals. Such rental activities create cross-selling opportunities in equipment sales, including rent-to-own purchase options on non-fleet rentals.

The company also provides ancillary equipment support activities such as equipment transportation, Global Positioning System signal subscriptions, and other precision farming products, farm data management products, and CNH Industrial finance and insurance products.

The company offers its customers a one-stop solution by providing equipment and parts sales, equipment repair and maintenance services, and rental functions in each store. The full-service approach provides Titan Machinery with multiple points of customer contact and cross-selling opportunities.

North America Agriculture customers vary from small, single-machine owners to large farming operations. For its Construction customers, they include a wide range of construction contractors, public utilities, forestry, energy companies, farmers, municipalities, and maintenance contractors. They vary in size from small, single-machine owners to large firms.

International customers vary from small, single-machine owners to large farming operations, primarily in the European countries of Bulgaria, Germany, Romania, and Ukraine. Titan Machinery also sells Case construction equipment in Bulgaria and Romania.

Titan Machinery Reportable Segment Revenue FY2023

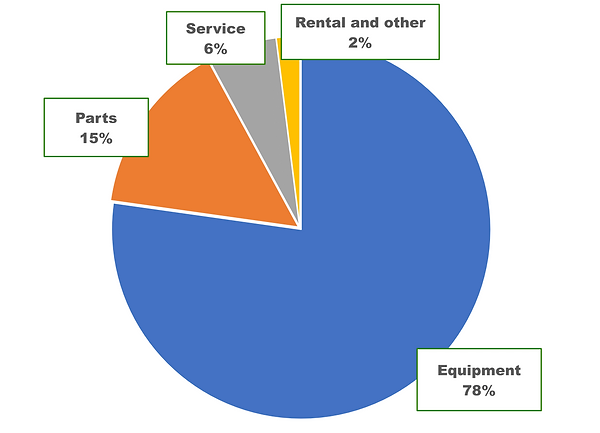

Titan Machinery Revenue Principal Business Activities Breakdown FY2023

Titan Machinery Economic Moat

Titan Machinery Economic Moat

Economic Moat: Narrow

There are many ways to identify Titan Machinery’s economic moat, but I focus on the above 5 types. The rating is purely subjective and based on my in-depth understanding and analysis of Titan Machinery. Please check my summary to understand more about the economic moat.

Performance Checklist

Is Titan Machinery’s revenue growing YoY for the past 5 years consistently? Yes.

Is the net income growing YoY for the past 5 years consistently? Yes.

Is the cash flow from operating activities growing YoY for the past 5 years consistently? Inconsistent.

Is the free cash flow positive for the past 5 years? No.

Is the gross margin % consistent/ growing for the past 5 years? Yes.

Is the EPS growing for the past 5 years? Yes.

Titan Machinery Revenue, Net Income, Operating Cash Flow, and FCF (USD Million)

Is the free cash flow per share growing for the past 5 years? No.

Titan Machinery FCF per Share

Management Effectiveness

Is Titan Machinery’s ROE consistently at 12%-15% YoY for the past 5 years? No.

Titan Machinery Return on Equity

Is the ROIC consistently at 12%-15% YoY for the past 5 years? No.

Titan Machinery Return on Invested Capital vs Weighted Average Cost of Capital

The trendline for the number of shares outstanding is flat.

Titan Machinery Shares Outstanding (Million Shares)

Titan Machinery Financial Health

Titan Machinery Financial Health (USD Million)

Current Ratio: 1.5 (pass my requirement of >1.0)

Debt-to-EBITDA: 3.8 (fail my requirement of <3.0)

Interest Coverage: 16.0 (pass my requirement of >3.0)

Debt Servicing Ratio: 7.9% (pass my requirement of <30.0%)

Dividend

Current Dividend Yield: Not applicable as Titan Machinery does not pay dividends.

Titan Machinery Stock Performance

The following graph compares the cumulative total return for the last trading day of the last five fiscal years on a $100 investment (assuming dividend reinvestment) on 31 Jan 2018, the last trading day before our fifth preceding fiscal year, in each of its common stock, the Russell 2000 Index and the S&P 500 Retail Index.

Titan Machinery Stock Performance

Titan Machinery Intrinsic Valuation

Estimated intrinsic value: $6.28

Value is calculated using the discounted cash flow method (taking into account their cash and debt) and scenario planning.

Average free cash flow used: USD$55M

Projected growth rate: 7% - 8%

Beta: 1.7

Discount rate: 11.5%

Margin of safety: 50% (Uncertainty: High)

Price range after the margin of safety: <$3.00

Date of calculation: 8 Nov 2023

Titan Machinery Valuation

Free cash flow used is a weighted average that is rounded to the nearest tens. In some instances, I used a more realistic number to represent the free cash flow.

Total debt and cash and short-term investments are last quarter figures that are rounded to the nearest tens. In some instances, I used more realistic numbers to represent them.

Titan Machinery Intrinsic Valuation

Titan Machinery Relative Valuation

Titan Machinery EV-to-EBITDA vs its peers

Titan Machinery Price-Earnings Ratio vs its peers

Titan Machinery Historical Price-Earnings Ratio

Additional Resources

I recommend reading University of Berkshire Hathaway as it greatly helps in my stock analysis. If you want a complete collection of recommended books, please visit here.

My Top Concern

One of the major concerns is the excessive reliance on CNH Industrial. Most Titan Machinery’s business, including the sales and distribution of new equipment, as well as equipment servicing, revolves around CNH Industrial.

In fiscal year 2023, CNH Industrial supplied approximately 76% of the new equipment sold in the Agriculture segment, 76% of the new equipment sold in the Construction segment, and 60% of the new equipment sold in the International segment.

Being overly dependent on a single supplier could potentially disrupt the business. For instance, issues in the supply chain and labor shortages could impact CNH Industrial's manufacturing output, resulting in Titan Machinery’s stores not receiving inventories in the expected quantities and timelines.

Any failure on the part of CNH Industrial to provide competitive products, or delays in introducing strategic new products to the market, could also affect Titan Machinery’s business.

Furthermore, Titan Machinery’s success is heavily contingent on the overall reputation, brand, and success of CNH Industrial, including its ability to maintain a competitive edge in product innovation, quality, and pricing.

The worst-case scenario would be if CNH Industrial were to terminate any or all its CNH Industrial Dealer Agreements, which would harm Titan Machinery.

Additionally, the conflict between Russia and Ukraine has posed challenges and risks for its operations in Ukraine.

As the outcome of the Russian military operation remains uncertain, it is impossible to predict when or if the business operations will resume. The instability has also affected the liquidity of local customers and their purchasing decisions.

These factors, along with others that have not been anticipated, could potentially hurt Titan Machinery’s profitability.

Summary for Titan Machinery

Titan Machinery possesses unique capabilities that enable it to establish a narrow economic advantage, specifically in terms of cost efficiency and intangible assets.

The company’s centralized inventory management system allows Titan Machinery to efficiently oversee inventory levels at each store while still offering a wide range of equipment and parts to customers.

The floorplan financing capacity also enables the company to purchase and maintain inventory to meet market demands opportunistically.

Another approach to reducing the cost per unit is to increase same-store sales. Titan Machinery has successfully achieved this by cross-selling to other business activities within the same store. Increasing same-store sales not only boosts current-period revenue but also augments potential future revenue over the lifespan of the sold equipment.

Titan Machinery has completed the acquisition of more than fifty dealerships across 11 U.S. states and 4 European countries. This includes CNH Industrial, a leading manufacturer and supplier of agricultural and construction equipment.

This acquisition has positioned the company as the largest retail dealer of Case IH Agriculture equipment globally, one of the largest retail dealers of Case Construction equipment in North America, and one of the largest retail dealers of New Holland Agriculture and New Holland Construction equipment in the U.S. However, this is not the sole factor contributing to the company's advantage in intangible assets.

Another significant intangible asset is Titan Machinery’s highly skilled service technicians. Not only are they well-trained, but they are also strategically located across the network of stores, enabling prompt scheduling of repair services.

In addition to technicians, product and application specialists provide valuable pre-sale and aftermarket services, including equipment training, best practices education, and precision farming technology support. This fosters customer loyalty and retention.

Even with its cost advantage and intangible assets, Titan Machinery still maintains a narrow economic advantage overall. This is primarily due to the absence of a network effect and low switching costs.

Titan Machinery has shown impressive performance over the past five years. The company has consistently witnessed year-over-year revenue growth, reflecting its strong market presence and operational efficiency. Similarly, net income has also demonstrated consistent growth, indicating effective cost management and revenue generation.

However, the trend in cash flow from operating activities has been somewhat inconsistent, suggesting potential fluctuations in the company's working capital management. Furthermore, Titan Machinery has not maintained a positive free cash flow over the past five years.

On a positive note, the gross margin percentage has remained consistent or even grown, underscoring the company's ability to maintain profitability. Additionally, earnings per share has seen an upward trajectory.

Titan Machinery's capital management has shown some interesting trends over the past five years. While the company's ROE hasn't consistently remained within the 12%-15% range year over year, it's noteworthy that Titan Machinery's ROE surpasses the industry average.

Similarly, the ROIC has not consistently fallen within the 12%-15% range annually, yet it consistently exceeds the WACC, indicating that the company is effectively utilizing its capital to generate returns.

It is worth mentioning that the number of Titan Machinery shares outstanding has remained steady over the past five years, which can be seen as a sign of stability in the company's capital structure.

Titan Machinery demonstrates a reasonably healthy financial position based on several key metrics. The current ratio, at 1.5, comfortably surpasses the desired threshold of 1.0, indicating that the company possesses ample current assets to cover its short-term liabilities.

However, the debt-to-EBITDA ratio stands at 3.8, slightly above the preferred limit of 3.0. While this suggests a relatively higher level of debt, it's important to note that the company maintains a robust interest coverage ratio of 16.0, indicating its ability to comfortably meet interest obligations.

Moreover, the debt servicing ratio of 7.9% falls well below the recommended maximum of 30.0%, underscoring Titan Machinery's ability to manage its debt obligations effectively.

Investing in Titan Machinery calls for careful consideration due to several key factors. While the company possesses a narrow economic moat, indicating a competitive advantage in its industry, its overall performance, capital allocation, and balance sheet have been deemed unsatisfactory.

This raises concerns about its ability to consistently generate robust returns for investors. Moreover, the investment carries a significant level of uncertainty, as the company's performance may be influenced by various market dynamics and internal factors.

Therefore, a prudent approach would necessitate a high margin of safety of at least 50% to account for the potential risks and uncertainties associated with investing in Titan Machinery. This cautious stance ensures that investors have a buffer in place to withstand any unforeseen challenges that may arise in the future.

Please help us report any inaccurate information here. Thank you.