Henry Schein, Inc. Fundamental Analysis

- Aug 5, 2024

- 14 min read

Disclaimer: This article by The Globetrotting Investor is general in nature. We aim to bring you long-term focused analysis driven by fundamental data, hence, providing you commentary based on historical data and analyst forecasts only using an unbiased methodology. This is not a buy/ sell recommendation, and it is solely for educational purposes. Please do your research before investing. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Please read the full disclaimer here.

Henry Schein, Inc.

Last Updated: 5 Aug 2024

NASDAQ: HSIC

GICS Sector: Healthcare

Sub-industry: Medical Distribution

Management

CEO: Stan Bergman

Tenure: 35.6 years

Stanley M. Bergman, or Stan, has helmed Henry Schein as CEO and Executive Chairman since 1989. His tenure extends back to 1982 as Executive Director. Bergman previously held leadership roles within the company, including President, Executive Vice President, and Vice President of Finance and Administration.

Beyond Henry Schein, he sits on numerous boards, including those of academic institutions, professional organizations, and corporations. A Certified Public Accountant, Bergman is deeply involved in the dental industry, serving on boards like the American Dental Association.

Bergman's leadership has driven significant growth and expansion at Henry Schein. In 2023, his strategies yielded stable patient flow and robust dental equipment sales, particularly in North America and Europe. The Specialty Business flourished with substantial growth in premium and value-priced product lines. Strategic acquisitions of Biotech Dental and S.I.N. Implant System solidified Henry Schein's position in Brazil.

Bergman's adaptability and customer-centric approach propelled the company forward in 2021. Previous acquisitions of North American Rescue and Lighthouse 360 in 2019 further expanded Henry Schein's market reach.

Let us now analyze the CEO’s compensation.

The total compensation refers to the sum of all forms of payments and benefits received by the CEO per year. This can include salary, bonus, stock options, and other perks.

The graph above shows that the CEO’s compensation has been consistent with the company's performance over the past year, which can generally be a positive indication.

When a CEO's pay reflects the company's success, it suggests their interests are aligned with shareholders. If the company thrives, the CEO benefits too. This incentivizes the CEO to make decisions that boost the company's long-term value.

Looking broadly at Henry Schein, Inc.’s management team, it has an average tenure of 11 years. It is considered experienced.

Business Overview

Henry Schein is a solutions provider for healthcare professionals. As the largest supplier of healthcare products and services, it primarily serves office-based dental and medical practitioners. The company aims to enhance practice efficiency and profitability and improve patient care.

Henry Schein stocks over 300,000 products across its extensive distribution network. With 36 distribution centers and 22 manufacturing facilities, the company facilitates rapid order fulfillment and operational efficiency. This robust infrastructure, coupled with competitive pricing and unwavering customer commitment, positions Henry Schein as a one-stop shop for customer needs.

The company operates through two segments: healthcare distribution and technology and value-added services. Both segments cater to the same customer base and offer diverse products and services. The dental business serves dental practitioners, laboratories, and institutions, while the medical business serves physicians, clinics, and various healthcare providers.

The healthcare distribution segment distributes consumable products, equipment, pharmaceuticals, diagnostic tests, and personal protective equipment, among other essentials. While the primary strategy involves distribution, Henry Schein also markets and sells its own high-quality, cost-effective consumable products and manufactures specialty dental products in oral surgery, implants, orthodontics, and endodontics.

The technology and value-added services segment provides software, technology, and support solutions to healthcare practitioners. Henry Schein One, its flagship product, offers practice management solutions for dental and medical professionals. Additional offerings include electronic health records, patient communication tools, analytics, and practice consultancy services.

Beyond core operations, Henry Schein offers repair services through 119 equipment sales and service centers worldwide. These centers provide installation and repair services for dental and medical equipment, ensuring that healthcare practices remain operational and efficient. Financial services are also available, offering customers access to third-party financing solutions for equipment, technology, and practice expansions. These services include non-recourse financing, business debt consolidation, commercial real estate financing, and more, often at rates lower than what customers might secure independently.

Trends, Competition, and Strategy Overview

Industry and demographics trends

The global healthcare distribution industry, serving office-based practitioners, is fragmented and diverse. It spans from solo practitioners to large group practices managed by dental support organizations (DSOs), medical group purchasing organizations (GPOs), or integrated delivery networks.

Due to limited storage in offices, healthcare supply distribution to practitioners involves frequent, small orders demanding rapid fulfillment. Purchasing decisions typically rest with practitioners, hygienists, or office managers. Practices often source supplies from multiple distributors.

Industry growth stems from an aging population, heightened health awareness, improved global access to care, advancing medical technology, new pharmaceuticals, and expanded insurance coverage. These factors offset the impacts of unemployment and technological advancements. The shift of procedures from hospitals to outpatient settings also boosts the non-acute market.

Industry consolidation is ongoing, with smaller distributors seeking partnerships with larger companies for growth and expanded offerings. Customer consolidation, driven by efficiency and cost containment, favors distributors offering broad product lines and competitive prices. This trend accelerates the growth of HMOs, group practices, and collective buying groups, demanding competitive pricing and specialized support. Technology solutions, including software, are increasingly sought to enhance practice efficiency.

Demographic trends signal market growth. The U.S. population aged 45 and older is projected to increase by approximately 11% between 2023 and 2033 and 21% by 2043. This compares to total U.S. population growth of roughly 6% and 11%, respectively.

The dental industry anticipates rising oral healthcare expenditures as the 45+ population expands. Demand for productivity-enhancing technologies grows amid lower insurance reimbursements. However, dental insurance coverage is expected to increase.

The medical market witnesses a continued shift of procedures from hospitals to physician offices and home health settings, creating opportunities. Vaccine, injectable, and pharmaceutical use in outpatient settings also grows.

Competition

Henry Schein faces intense competition. Numerous suppliers offer similar products to customers, while competitors often secure exclusive marketing rights from manufacturers. Manufacturers increasingly bypass distributors by selling directly to end-users, particularly in dental specialties and medical markets.

In North America, Henry Schein rivals other distributors and manufacturers in dental and medical products, primarily through price, product range, online services, customer support, and additional offerings.

Key competitors in the U.S. dental market include Patterson Dental and Benco Dental Supply. The medical market is dominated by McKesson Corporation and Medline Industries, with regional and local distributors posing additional challenges. Dental software rivals include Patterson Dental, Carestream, and several other companies. Other software sectors, such as revenue cycle management, are competitive with companies like Vyne Therapeutics and EDI-Health Group. The medical practice management and electronic medical records market is fragmented, with competitors like NextGen and eClinicalWorks.

Outside the U.S., Henry Schein holds a unique position as the only global dental practice distributor but faces local and regional competition. Major international rivals include GACD Group, Proclinic SA, Lifco AB, Planmeca Oy, and Billericay Dental Supply.

Strategy

Henry Schein aims to be a leading provider of innovative, integrated healthcare products and services, serving as trusted advisors and consultants to their customers. They aim to help clients deliver top-quality patient care while enhancing practice management efficiency and profitability.

The company's BOLD+1 Strategic Plan outlines key strategies to achieve this mission: build complementary businesses, operationalize distribution for enhanced customer experience, leverage relationships through the "One Schein" approach, drive digital transformation, and create value for stakeholders.

To achieve these goals, Henry Schein focuses on several strategic initiatives. First, it seeks to deepen relationships with its existing customer base by increasing sales and reinforcing its position as a primary supplier. A comprehensive product range, software solutions, and full-service support contribute to customer retention and growth.

Second, the company strives to expand its customer base by enhancing sales force productivity, refining marketing efforts, and targeting new market segments. This includes independent practices, DSOs, community health centers, and medical settings beyond traditional offices like urgent care clinics and retail pharmacies.

Third, Henry Schein emphasizes cross-selling value-added products and services, such as dental software to existing dental customers and vaccines to healthcare practitioners. This strategy also extends to larger healthcare organizations like health systems and integrated delivery networks.

Finally, strategic acquisitions and joint ventures play a crucial role in the company's growth strategy. Henry Schein seeks investments that expand its customer base, geographic reach, and access to new products and technologies.

Through these strategies, Henry Schein aims to strengthen its position as a leading global provider of healthcare products and services, ensuring it meets the evolving needs of its customers while driving growth and value creation.

Henry Schein, Inc. Economic Moat

There are many ways to identify Henry Schein, Inc.’s economic moat, but I focus on these 5 sources. The rating is purely subjective and is based on my in-depth understanding of the company.

Economic Moat: Narrow

Henry Schein’s economic moat is primarily anchored by its intangible assets and cost advantage.

Years of cultivating an expansive distribution network underpins efficient product delivery and exceptional customer service. The company's deep-rooted relationships with a vast client base solidify its market position and generate consistent revenue. Exclusive supplier partnerships, including distribution agreements for specialized products, further differentiate its offerings.

Moreover, a commitment to regulatory compliance in the medical and dental sectors enhances trust and reliability, reinforcing its intangible asset base.

Henry Schein leverages substantial cost advantages as a behemoth in healthcare product distribution. Economies of scale, stemming from bulk purchasing and fixed cost distribution over massive sales volumes, reduce unit costs.

Operational efficiency, optimized through a sprawling distribution network and refined supply chain, keeps operating expenses low. Global sourcing exploits regional cost disparities, amplifying overall cost advantages.

Henry Schein's scale and reach pose significant challenges to potential competitors, especially in dental and medical supply distribution. The company’s dominance in specific niches, such as dental practices, where tailored services complement its size, creates a barrier to entry. Smaller rivals struggle to match Henry Schein's comprehensive product range and service depth.

While network effects and switching costs exist, they are less pronounced.

An extensive and growing customer base allows Henry Schein to offer superior pricing and more comprehensive services to healthcare providers, attracting additional clients. The company’s extensive supplier network fosters a network effect, with suppliers prioritizing partnerships that grant access to a vast customer base, resulting in exclusive or preferential agreements.

Henry Schein's integrated solutions lock in customers, including supply chain management, e-commerce platforms, and practice management software. Transitioning to another provider necessitates a supplier change and potential operational overhauls, creating substantial switching costs.

Henry Schein, Inc. Performance

My quick performance checklist:

Has Henry Schein, Inc.'s revenue consistently grown year over year for the past five years? Yes, except for a slight dip in the fiscal year 2023, which does not concern me.

Is the net income consistently increasing yearly for the past five years? No, it is relatively inconsistent.

Has the cash flow from operating activities shown consistent year-over-year growth for the past five years? No, it is decreasing.

Has the free cash flow remained positive for the past five years? Yes.

Is the gross margin % consistent or growing over the past five years? Yes, it is consistent at around 30%, which is better than its industry peers.

Has the EPS shown growth over the past five years? No, it is relatively inconsistent.

Henry Schein’s performance in 2023 was marked by both gains and setbacks across its various business segments.

Dental net sales saw a modest increase of 0.9%. However, internally generated local currency sales for dental merchandise and equipment experienced declines, primarily due to the negative impact of a cybersecurity incident. This incident significantly disrupted operations, affecting the company’s ability to meet demand.

Personal protective equipment (PPE) product sales were particularly hard-hit, dropping from approximately $448 million in 2022 to $338 million in 2023—a decrease of $110 million or 24.5%. This decline in PPE sales, driven by lower market prices and reduced demand, accounted for 1.5% of the total dental net sales for the year.

Medical net sales dropped 10.3% in 2023. The cybersecurity incident and lower PPE and COVID-19 test kit sales drove this decline. Excluding PPE products and COVID-19 test kits, the company’s internally generated local currency sales in the medical segment fell by 2.2%, reflecting broader challenges in the market.

On a more positive note, net sales of technology and value-added services surged 11.4% in 2023. Growth in practice management software, revenue cycle management solutions, and analytical products fueled this increase.

The cybersecurity incident had little impact on this segment. However, the increase in sales was slightly offset by the expiration of a profitable government contract in one of the company’s value-added services businesses at the end of 2022.

Operating costs climbed in 2023 due to increased payroll, travel, and acquisition expenses. A remeasurement gain offset some costs, but restructuring charges, including severance, asset impairments, lease termination costs, and $11 million in cybersecurity remediation expenses, eroded profits.

Has free cash flow per share increased over the last five years? No, it is relatively inconsistent.

Management Effectiveness

Has Henry Schein, Inc.'s ROE stayed within or above the 12%-15% range year over year for the past five years? Yes, but it varies widely year over year.

A stronger ROE relative to the industry suggests effective management. This implies the company is efficiently utilizing its resources to generate profits at a higher rate than competitors.

Has the ROIC stayed within or above the 12%-15% range year over year for the past five years? No, it has always been below 12%.

When a company's ROIC falls below its WACC, it means its investments aren't generating enough profit to even cover the base cost of that capital. Imagine you borrow money at 10% interest to invest in something, but that investment only returns 8%. You're losing money on the deal.

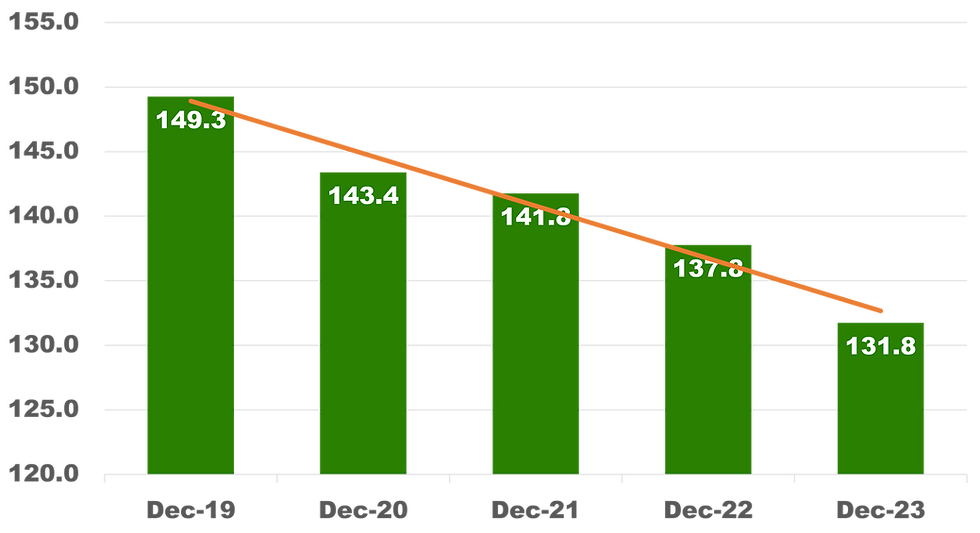

The trendline for the number of shares outstanding is declining, which would please an investor.

Henry Schein’s share repurchase program originally allowed the company to repurchase up to two million shares of its common stock before stock splits (eight million shares after stock splits). The program has since been increased by an additional $4.9 billion, for a total of $5.0 billion, including $400 million authorized on 8 Feb 2023.

As of 30 Dec 2023, the company had repurchased approximately $4.7 billion of common stock (90,394,805 shares) under these initiatives and has $265 million available for future share repurchases.

Henry Schein, Inc. Financial Health

Current Ratio: 1.8 (pass my requirement of >1.0, but <3.0)

I use the current ratio instead of the quick ratio to analyze the company’s liquidity. This is because I want a general overview of financial health and the company’s inventory is a significant asset and easily be converted to cash.

The trend of its current ratio has been increasing over the past five years and is generally a good sign.

A rising current ratio suggests the company has a growing pool of current assets (cash, inventory, receivables) relative to its current liabilities (short-term debts). This signifies a greater ability to meet its short-term obligations without needing to sell long-term assets or raise additional funds.

There's a better cushion for the company to absorb unexpected financial strains. Investors often view this favorably.

Henry Schein, Inc.'s current ratio is better than its industry average of 1.4, which is above the industry median.

Debt-to-EBITDA: 3.1 (fail my requirement of <3.0)

This ratio measures a company's ability to pay off its debt with its operating income. A higher ratio may indicate higher financial risk, while a lower ratio suggests more manageable debt levels relative to earnings.

I use the debt-to-EBITDA ratio instead of the net debt-to-EBITDA ratio because I want a straightforward view of the company's gross leverage, focusing on the total debt burden without accounting for cash reserves.

Debt-to-EBITDA can present a more conservative view of a company's financial risk by not considering cash. It is useful for me to understand the worst-case scenario regarding the company's ability to service its debt. Also, it helps that every company has different cash management strategies.

Henry Schein, Inc.’s debt-to-EBITDA ratio has increased over the past five years. The increase was due to higher debt and lower EBITDA, which is usually not a good sign.

A rising debt-to-EBITDA suggests the company's EBITDA might not be sufficient to cover its growing debt obligations. This indicates a weaker financial position and increases the risk of default.

As the ratio increases because EBITDA is decreasing, it indicates a potential decline in profitability and operational performance.

When compared to its industry, Henry Schein, Inc.'s debt-to-EBITDA ratio is worse, as it is above the industry median of 2.3.

Interest Coverage: 6.3 (pass my requirement of >3.0)

Debt Servicing Ratio: 15.4% (pass my requirement of <30.0%)

Henry Schein, Inc. Stock Performance

The graph below compares the cumulative total stockholder return on $100 invested, assuming the reinvestment of all dividends, on 29 Dec 2018, the last trading day before the beginning of Henry Schein’s 2019 fiscal year, through the end of its 2023 fiscal year with the cumulative total return on $100 invested for the same period in the Dow Jones U.S. Health Care Index and the Nasdaq Stock Market Composite Index.

Henry Schein, Inc. Intrinsic Valuation

Estimated intrinsic value: USD $49.50

Value is calculated using the discounted cash flow method (considering their cash and debt) and scenario planning.

Average free cash flow used: USD $480M

Projected growth rate: 5% - 8%

Beta: 0.8

Discount rate: 7.0%

Ideal margin of safety: 50% (Uncertainty: High)

Price range after the margin of safety: <USD $25.00

Date of calculation: 5 Aug 2024

I use the past 5 years' free cash flow and apply a weighted average, giving more focus on the recent years. I then round the average to the nearest tens. In some instances, I use a more realistic number to represent the free cash flow.

The total debt and cash and short-term investments are the last quarter figures that are rounded to the nearest tens. In some instances, I use more realistic numbers to represent them.

Henry Schein, Inc. Relative Valuation

My Concerns

Henry Schein relies heavily on third-party manufacturers for a substantial portion of its products. These suppliers often lack long-term contracts, and a few key providers account for a significant chunk of Schein’s purchases.

For instance, in 2022, the top 10 healthcare distribution suppliers accounted for approximately 28% of Henry Schein’s total purchases, with the largest single supplier making up about 4%. This dependence exposes the company to supply chain disruptions, such as production halts due to government violations or manufacturing issues, which could have a significant impact on the company's operations and reputation.

The uncertainty of finding suitable replacements promptly is a significant concern, and prolonged shortages, especially for high-selling items, can severely impact sales, operations, customer relationships, and reputation.

Changes in supplier rebates or purchasing incentives present another risk to Henry Schein’s business. The company often receives rebates or incentives based on achieving certain growth targets set by suppliers. However, these suppliers might reduce or eliminate such incentives or raise the growth targets to unattainable levels.

Factors beyond Henry Schein’s control, such as shifts in customer preferences, supplier consolidation, or supply chain issues, could prevent the company from meeting these growth goals, leading to a decrease in rebates or incentives. Such outcomes could have a significant negative impact on Henry Schein’s performance.

The competitive landscape of the healthcare products distribution industry poses additional challenges. Henry Schein competes with numerous companies, including major manufacturers and distributors, some of which have greater financial resources.

This competition is intensified by industry consolidation, price wars, and the potential unavailability of products due to manufacturing disruptions or new competitors. The rise of third-party online commerce threatens traditional distribution models, requiring Henry Schein to adapt quickly to technological changes and evolving consumer demands.

The expansion of group purchasing organizations (GPOs), dental support organizations (DSOs), and provider networks adds another layer of complexity to Henry Schein’s competitive environment. These entities often secure more favorable pricing from manufacturers, disadvantaging companies like Henry Schein.

As the influence of GPOs, DSOs, and provider networks grows, purchasing decisions may shift to organizations with which Henry Schein lacks established relationships. Although the company is working to secure similar pricing terms and build relationships with these entities, success is not guaranteed. This situation could hinder Henry Schein’s ability to compete effectively, potentially impacting its financial results.

Please help us report any inaccurate information here. Thank you.

Comments