Paramount Global Fundamental Analysis

Disclaimer: This article by The Globetrotting Investor is general in nature. We aim to bring you long-term focused analysis driven by fundamental data, hence, providing you commentary based on historical data and analyst forecasts only using an unbiased methodology. This is not a buy/ sell recommendation, and it is solely for educational purposes. Please do your research before investing. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Please read the full disclaimer here.

Paramount Global

Last Updated: 18 May 2023

NASDAQ: PARA

GICS Sector: Communication Services

Sub-Industry: Entertainment

Table of Contents

You can download a summary of Paramount Global's fundamental analysis in PDF here.

Management

CEO: Bob Bakish

Tenure: 3.4yrs

Paramount Global's management team has an average tenure of 3.4 years. It is considered experienced.

Source of Revenue

Paramount Global operates as a media and entertainment company worldwide. The company operates through TV Media, Direct-to-Consumer, and Filmed Entertainment segments.

Direct-to-Consumer: The Direct-to-Consumer segment consists of a portfolio of domestic and international pay and free streaming services.

Filmed Entertainment: The Filmed Entertainment segment consists of the production and acquisition of films, series and short-form content for release and licensing in media around the world, including in theatres, on streaming services, on television, and through digital home entertainment and DVDs.

TV Media

The TV Media segment consists of (1) domestic and international broadcast networks and owned television stations; (2) domestic and international extensions of cable networks; and (3) domestic and international television studio operations, and production and distribution of first-run syndicated programming.

The segment generates revenue mainly from advertising, affiliate and subscription fees received from multichannel video programming distributors and third-party live television streaming services for the carriage of cable networks and owned television stations, and fees received from television stations for their affiliation with the CBS Television Network. The segment also earns from licensing and distribution of its content and other rights. Additionally, TV Media has digital properties such as CBS News Streaming and CBS Sports HQ.

Broadcast

CBS Television Network: The CBS Television Network distributes various entertainment, news, public affairs, and sports programming through CBS Entertainment, CBS News, and CBS Sports. CBS Network content is available on various internet platforms, including streaming services, MVPDs, and vMVPDs. CBS Entertainment acquires or develops programming for the CBS Network, which includes various shows such as comedies, dramas, reality, kids’ programs, and late-night. CBS News operates a worldwide news organization, providing regularly scheduled news and public affairs programs. CBS Sports broadcasts on the CBS Network include certain regular season and playoff NFL games, the NCAA Division I Men’s Basketball Tournament, regular-season college football games, and other sporting events.

CBS Stations: CBS Stations consists of 29 owned broadcast television stations in the US. All the stations operate under licenses granted by the FCC and broadcast news, public affairs, sports, and other programming to serve their local markets. CBS owns multiple stations in the same Nielsen-designated market area in 10 major markets, including New York, Los Angeles, and Philadelphia. The stations also offer local news through local versions of CBS News Streaming.

International Free-to-Air Networks: The company operates several free-to-air networks worldwide, including Network 10 in Australia, Channel 5 in the UK, Telefe in Argentina, and Chilevisión in Chile. Each network has several brands, and they offer various programs and services such as news, sports, and channels on Pluto TV.

Cable

Paramount Media Networks: Paramount Media Networks is a collection of well-known brands that connect with audiences worldwide, including MTV, Comedy Central, CMT, and TV Land. They offer various entertainment programming such as movies, documentaries, scripted and unscripted series, sports, and live events. The brands cover different themes such as comedy, music, LGBTQ+ lifestyle, pop culture, and more.

Nickelodeon: Nickelodeon is a brand that offers original and licensed series for kids and families across animation, live-action, and preschool genres. It includes various brands like Nick Jr., Nick at Nite, TeenNick, Nicktoons, and Nick Music. Nickelodeon is also a significant component of the company's global consumer products business and licenses its brands for location-based experiences such as hotels and theme parks.

BET Media Group: BET Media Group creates and distributes premium entertainment, music, news, and public affairs content for Black audiences through various multiplatform extensions, including BET Studios, BET Digital, BET Her, BET Music Networks, BET Home Entertainment, BET Live, BET International, and VH1.

CBS Sports Network. CBS Sports Network is a 24-hour cable channel that broadcasts live sports events such as college football, basketball, and hockey. It also offers original programming and provides coverage for major events like the NCAA Division I Men’s Basketball Tournament.

Studios

CBS Studios, MTV Entertainment Studios, and Paramount Television Studios produce content for broadcast, cable, and streaming platforms. CBS Media Ventures produces and distributes original series programming licensed to TV stations for local broadcast and streaming, and also engages in national advertising and marketing sales. CBS Studios has an extensive library of intellectual property, including the Star Trek franchise, and produces late-night and daytime talk shows.

Direct-to-Consumer

The Direct-to-Consumer segment includes pay and free streaming services such as Paramount+, Pluto TV, BET+, and Noggin. Revenues come from advertising and subscriptions, with subscriptions accounting for 69% and advertising for 31% of the segment's total revenues in 2022. SHOWTIME will be integrated into Paramount+ across both streaming and linear platforms in 2023.

Paramount+: Paramount+ is a global streaming service that offers live sports, news, and entertainment content, with an extensive collection of original series, shows, and movies across all genres. It features live-streamed CBS Sports programming, including the NFL and NCAA Division I Men's Basketball, as well as matches from various domestic and international soccer leagues. Paramount+ has two versions in the U.S.: Premium, an ad-free subscription, and Essential, an ad-supported option that includes NFL but not live-streamed local CBS Stations.

Pluto TV: Pluto TV is a global free ad-supported streaming service with curated live linear channels and on-demand content in various genres, including movies, TV series, sports, news, reality, and music, among others. It also offers Spanish-language channels through Pluto TV en español. The service can be accessed through connected devices, mobile, and the internet.

BET+: BET+, a joint venture between BET and Tyler Perry Studios, is a subscription streaming service in the U.S. focused on Black audiences, featuring movies, television, stand-up comedy, award shows and specials. BET+ is home to exclusive original content from leading Black creators.

SHOWTIME OTT: SHOWTIME OTT is Showtime Networks’ premium subscription streaming service in the U.S.

Noggin. Noggin is an educational platform by Nickelodeon that provides an interactive learning experience for preschoolers. It includes games, videos, and books, as well as advertising-free episodes of popular preschool shows. It is designed to foster curiosity and build early math, literacy, social, and emotional skills.

Filmed Entertainment

The segment produces and acquires films, series, and short-form content for release and licensing across various media worldwide. The segment's revenue is primarily generated from the release or distribution of films theatrically and licensing of film and TV content. In 2022, the segment's revenues were composed of 33% theatrical, 66% licensing and other, and 1% advertising.

Paramount Pictures: A producer and global distributor of filmed entertainment since 1912, Paramount Pictures is an iconic brand with an extensive library of films, which includes such classics as Titanic, Forrest Gump and The Godfather, and well-known franchises such as Mission: Impossible and Transformers.

Paramount Players: Paramount Players focuses on creating genre films from distinct, contemporary voices and properties, as well as drawing from Paramount’s rich library of content. Paramount Players also produces films for initial release on Paramount+.

Paramount Animation: Paramount Animation develops and produces franchise and original animated films, including drawing from the Paramount Pictures and Nickelodeon libraries.

Nickelodeon Studio: Nickelodeon Studio produces and distributes animated and live-action series, films, made-for-television movies and short-form content for kids and families across multiple platforms worldwide.

Awesomeness: Awesomeness creates content focused on the global Gen Z audience through its digital publishing, film, and television studio divisions.

Miramax: Miramax, a joint venture with beIN Media Group, is a global film and television studio with an extensive library of content. We have exclusive, long-term rights to distribute Miramax’s library, as well as certain rights to co-produce, co-finance and/or distribute new film and television projects.

The Filmed Entertainment segment produces and acquires films for release and licensing in various media around the world, including in theatres and on streaming services. They also cofinance and/or co-distribute films with third parties, including other studios, and enter into financing arrangements where third parties participate in the financing of a film or group of films in exchange for economic participation and partial copyright interest.

The company distributes films worldwide through various media and third-party distributors, and markets and distributes its own theatrical and home entertainment releases domestically. Internationally, they distribute theatrical releases through their international affiliates or United International Pictures, their joint venture with Universal Studios. They also license films and television shows to various platforms. In 2022, they expanded their global footprint and built distribution partnerships with industry leaders, launched Paramount+ in multiple countries, and launched Pluto TV in Canada and the Nordics.

Paramount Global Reportable Segment Revenue FY2022

Paramount Global Economic Moat

Paramount Global Economic Moat

Economic Moat: Narrow

There are many ways to identify Paramount Global’s economic moat, but I focus on the above 5 types. The rating is purely subjective and based on my in-depth understanding and analysis of Paramount Global. Please check my summary to understand more about the economic moat.

Performance Checklist

Is Paramount Global’s revenue growing YoY for the past 5 years consistently? Yes.

Is the net income growing YoY for the past 5 years consistently? No.

Is the cash flow from operating activities growing YoY for the past 5 years consistently? No.

Is the free cash flow positive for the past 5 years? No.

Is the gross margin % consistent/ growing for the past 5 years? No.

Is the EPS growing for the past 5 years? No.

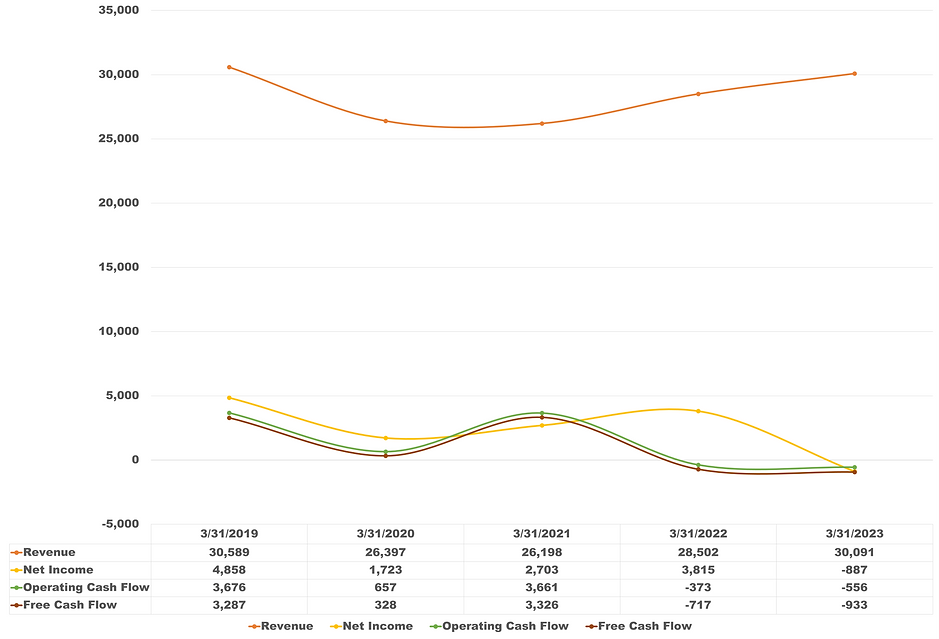

Paramount Global Revenue, Net Income, Operating Cash Flow, and FCF (USD Million)

Is the free cash flow per share growing for the past 5 years? No.

Paramount Global FCF per Share

Management Effectiveness

Is Paramount Global’s ROE consistently at 12%-15% YoY for the past 5 years? Inconsistent.

Paramount Global has a negative ROE as it is currently unprofitable.

Is the ROIC consistently at 12%-15% YoY for the past 5 years? No.

Paramount Global Return on Invested Capital vs Weighted Average Cost of Capital

The trendline for the number of shares outstanding is increasing, which is something that an investor would not be pleased to see.

Paramount Global Shares Outstanding (Million Shares)

Paramount Global Financial Health

Paramount Global Financial Health (USD Million)

Current Ratio: 1.12 (pass my requirement of >1.0)

Debt-to-EBITA: 26.18 (fail my requirement of <3.0)

Interest Coverage: 0.81 (fail my requirement of >3.0)

Debt Servicing Ratio: 425.11% (fail my requirement of <30.0%)

Dividend

Current Dividend yield: 1.3%

Have the dividend payments been stable for the past 5 years? Yes.

Have the dividend payments been growing for the past 5 years? No.

Paramount Global’s dividend payments are not covered by its earnings and its cash flows.

Paramount Global Stock Performance

The following graph compares the cumulative total stockholder return of Paramount Global Class B Common Stock with the cumulative total return on the companies listed in the S&P 500 index and the S&P 500 Media and Entertainment Index.

The performance graph assumes $100 invested on 31 December 2017 in each of Paramount Global Class B Common Stock, the S&P 500, and the S&P 500 Media and Entertainment Index, including reinvestment of dividends, through the calendar year ended 31 December 2022.

Paramount Global Stock Performance

Paramount Global Intrinsic Valuation

Estimated intrinsic value: $17.67

Value is calculated using discounted cash flow method (taking into account their cash and debt) and scenario planning.

Average free cash flow used: USD$800M

Projected growth rate: 5% - 6%

Beta: 1.4

Discount rate: 9.0%

Margin of safety: 50% (Uncertainty: High)

Price range after the margin of safety: <$9.00

Date of calculation: 18 May 2023

Free cash flow used is a weighted average that is rounded to the nearest tens. In some instances, I used a more realistic number to represent the free cash flow.

Total debt and cash and short-term investments are not included in this case. As the total debt significantly surpasses its cash and short-term investments, the inclusion of these two numbers into the above calculation will yield a negative intrinsic value. This is a huge sign of concern.

Paramount Global Intrinsic Valuation

Paramount Global Relative Valuation

Paramount Global EV-to-EBITDA vs its peers

Paramount Global Price-Sales Ratio vs its peers

Paramount Global Historical Price-Sales Ratio

Additional Resources

I recommend reading University of Berkshire Hathaway as it greatly helps in my stock analysis. If you want a complete collection of recommended books, please visit here.

My Top Concern

The entertainment industry faces intense competition in attracting creative talent, producing and acquiring high-quality content, and distributing it on various platforms. The competition comes from various sources, including television networks, streaming services, social media, film studios, independent producers, and consumer products companies. These competitive pressures may increase, resulting in significant cost increases and difficulties in producing or acquiring content. Consolidation among competitors may further increase competitive pressures. This competition could result in lower revenues, increased expenses, and decreased profitability. There is no guarantee that Paramount Global can compete successfully in the future against existing or new competitors.

The next concern that I have is the economic conditions in various markets worldwide affecting the different aspects of the company's businesses. Volatility in financial markets, decreasing economic growth, and inflation can impact the company's ability to obtain cost-effective financing. Economic conditions in each market can also affect the company's audience's discretionary spending and its partners' advertising spending.

Political risks inherent in conducting a global business, such as retaliatory actions by governments, the presence of corruption in certain markets, and conflict, could create instability in any market where the company operates. These risks could result in a reduction in revenue or loss of investment.

Lastly, Paramount Global relies heavily on advertising revenues, which could be negatively impacted by changes in consumer preferences and the evolving advertising market. The strength of the advertising market is also subject to macroeconomic conditions and other factors such as pandemics, and political uncertainty. The company's ability to generate advertising revenue is also dependent on audience demand for its content, advertising rates, and accurate measurement of viewership across multiple platforms. The company may also experience variability in advertising revenues due to major sports events and political elections. Additionally, compliance with global laws and regulations could limit the company's ability to target and measure audiences.

Summary for Paramount Global

In the media industry, the value of video content is expected to continue to increase despite changes in distribution markets. The ongoing demand for content means that content creation is not a zero-sum game, and high-quality content will always have a market.

Paramount Global, which was formed from the merger of Viacom and CBS, has a competitive edge in producing high-quality content. This is mainly due to its CBS broadcast network, a range of cable networks with global reach, production studios, and an expanded content library. All these contribute to the company’s strong intangible assets.

As one of the four major national broadcast networks and affiliated TV stations in 16 markets, CBS is the only outlet that can reach almost all of the 120 million households in the US. Despite a decline in network ratings, network ratings still surpass cable ratings and provide advertisers with a way to reach a large number of consumers. The network also serves as an outlet for CBS Studios, which produces many hit programs annually.

As the value of high-quality content is expected to rise, production studios are particularly appealing assets for the company.

CBS also has a strong portfolio of sports rights, which include the NFL, college football, and college basketball. Live sports remain largely unaffected by DVR/ time-shifted viewing and continue to attract a crucial advertising demographic of males.

The combination of highly-rated original programs and exclusive sports rights may allow CBS to increase its revenue from retransmission fees and reverse compensation.

Besides the quality of content, Paramount establishes strong brand recognition and customer loyalty in several markets with different demographics, further strengthening its intangible assets.

Paramount Global owns two strong pay-TV channels, Nickelodeon and MTV, with Nickelodeon being the top domestic cable channel for young children. While MTV's cash flow is not as strong as Nickelodeon's, the brand has strong international appeal, with more than 900 million cumulative subscribers worldwide. Paramount also owns other notable brands, such as VH1, Comedy Central, and BET.

The entertainment industry has a high barrier to entry, particularly in launching a new cable channel with widespread distribution. This is due to the exorbitant cost of creating new high-quality content and the difficulty in attracting an audience in today's crowded streaming market. Paramount spends more than $3 billion annually on content creation for its pay-TV channels, but the wide-open nature of the internet makes it difficult to stand out among the vast array of choices. Paramount also leverage its competitive advantage by rebranding an existing channel, as they did with the Paramount Channel (previously Spike Network), to quickly gain carriage. With over 310 channels in 180 countries broadcasting in 46 languages and over 4.4 billion cumulative subscribers, Paramount Global has a significant advantage over new entrants.

Paramount has other areas of economic moat, including network effects and cost advantages. The company enjoys network effects in its media and entertainment businesses, where the value of its cable and streaming networks increases as they attract more viewers. Additionally, Paramount Global benefits from economies of scale due to its size and diversified operations. This allows the company to leverage its distribution networks, and marketing resources to lower its costs and increase its margins. These factors give Paramount Global a competitive edge and make it challenging for new entrants to match the company's scale and reach.

Based on the analysis of Paramount Global's competitive advantages, including its strong portfolio of cable networks, valuable content library, and exclusive sports rights, as well as its network effects and economies of scale, it can be concluded that the company has a narrow economic moat. While Paramount has some formidable competitive advantages, the company is not invulnerable to competition.

Paramount Global has been consistently growing its revenue year-over-year for the past 5 years. However, the net income and cash flow from operating activities have not shown the same consistency, failing to maintain a YoY growth pattern. Moreover, the company reported a negative free cash flow in 2022. Unfortunately, the gross margin percentage has not been consistent or growing for the past 5 years, leading to poor overall performance.

The company's capital allocation strategy has not been optimal and requires improvement. Paramount Global's ROE has not been consistently at 12%-15% YoY for the past 5 years and is currently negative as the company is unprofitable. Additionally, the ROIC has not consistently met this benchmark either. The WACC is 8 times higher than the ROIC, indicating that the company may not be generating enough returns to cover its cost of capital. To compound matters, the number of shares outstanding is increasing, which could be concerning for investors as it can dilute the value of their holdings.

Paramount Global's financial health is concerning, with several key financial metrics falling short of the healthy standards. While the company's current ratio of 1.12 meets the requirement of being greater than 1.0, indicating that the company has enough current assets to cover its current liabilities, other metrics paint a more troubling picture. The debt-to-EBITA ratio of 26.18 falls far short of the desired threshold of less than 3.0, indicating that the company has a significant amount of debt compared to its earnings. The interest coverage ratio of 0.81 also fails to meet the requirement of greater than 3.0, indicating that the company may struggle to cover its interest expenses. Finally, the debt servicing ratio of 425.11% significantly exceeds the desired threshold of less than 30.0%, indicating that the company may have difficulty servicing its debt.

Investing in Paramount Global carries a high level of uncertainty due to several factors. Firstly, the company has a narrow economic moat, which may make it difficult for it to maintain its competitive position in the market. Secondly, the company's performance has been unsatisfactory, with inconsistent revenue growth, negative free cash flow, and poor gross margin percentage. Thirdly, the company's capital allocation strategy has not been efficient, and the balance sheet is concerning. Given these challenges, investors looking to invest in Paramount Global would require a high margin of safety of at least 50% to account for the risk involved. Investing in Paramount Global at this time requires a cautious approach due to the high level of uncertainty.

Please help us report any inaccurate information here. Thank you.