Meta Platforms Inc Fundamental Analysis

Disclaimer: This article by The Globetrotting Investor is general in nature. We aim to bring you long-term focused analysis driven by fundamental data, hence, providing you commentary based on historical data and analyst forecasts only using an unbiased methodology. This is not a buy/ sell recommendation, and it is solely for educational purposes. Please do your research before investing. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Please read the full disclaimer here.

Meta Platforms Inc

Last Updated: 20 Mar 2023

NASDAQ: META

GICS Sector: Communication Services

Sub-Industry: Internet Content & Information

Table of Contents

You can download a summary of Meta Platforms Inc's fundamental analysis in PDF here.

Management

CEO: Mark Zuckerberg

Tenure: 18.5 years

Meta Platforms, Inc’s management team has an average tenure of 3.2 years. It is considered experienced.

Source of Revenue

Meta Platforms Inc engages in the development of products that enable people to connect and share with friends and family through various devices, discover and learn about the world around them, and share experiences with a range of audiences.

Meta's goal is to move beyond 2D screens and towards immersive experiences like augmented and virtual reality to help build the metaverse, which they believe will be the next evolution in social technology. Meta envisions the metaverse as an entire ecosystem of experiences, devices, and technologies and believes it will become the future of social interaction and the next computing platform.

The company operates in two segments: Family of Apps (FoA) and Reality Labs (RL).

Meta's main source of revenue is from selling advertising placements on their family of apps, which includes Facebook, Instagram, and Messenger. These ads allow marketers to reach people for various marketing objectives such as lead generation and driving awareness. In addition to advertising, Meta is also generating revenue through the development of the metaverse, which includes sales of consumer hardware products, software, and content.

Source: Meta Platforms

Family of Apps Products

Facebook: Facebook enables individuals to create and foster communities, leading to a closer global community. It provides a platform for people to share their everyday experiences, engage in discussions, establish, and strengthen relationships, explore their interests, and even create opportunities for economic growth. This can be done through various features, including Feed, Reels, Stories, Groups, and others.

Instagram: Instagram allows people to feel more connected to the people and things they care about. With its various features such as Feed, Stories, Reels, Video, Live, Shops, and messaging, people can interact and showcase themselves through photos, videos, and private messaging. Moreover, they can explore and shop from their preferred businesses.

Messenger: Messenger is a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio and video calls.

WhatsApp: WhatsApp is a simple and secure messaging application that is used by people and businesses around the world to communicate and transact privately.

Reality Labs Products

Meta's investment in the metaverse is a long-term strategy that involves exploring and developing new technologies that are not yet on the market, such as neural interfaces and AI-based innovations, that will help build the next-generation interfaces and immersive experiences. By investing in these technologies and developing early metaverse experiences through their augmented and virtual reality products, Meta is preparing for the future of social technology, which they believe will be centred around the metaverse.

However, the development of the metaverse ecosystem is inherently difficult to predict, and it is uncertain when and how it will fully emerge. Therefore, Meta expects their Reality Labs segment to continue operating at a loss for the foreseeable future. Nonetheless, they believe that the metaverse presents a significant opportunity for monetisation across various domains, including advertising, hardware, and digital goods.

Meta's current product offerings consist of the Meta Quest virtual reality devices, software, and content available through the Meta Quest Store. These products enable a variety of social experiences, such as gaming, fitness, and entertainment, that allow people to connect regardless of physical distance.

Meta has also launched Horizon Worlds, a social platform where people can interact with friends, play games, attend virtual events, and meet new people. Additionally, Horizon Workrooms is a virtual reality space designed for teams to connect and collaborate remotely.

As part of Meta’s virtual reality initiatives, the company has also introduced mixed reality capabilities through its Meta Reality system on Meta Quest Pro, which allows users to experience the immersion and presence of virtual reality while still being grounded in the physical world. As part of its augmented reality initiatives, they have introduced Ray-Ban Stories smart glasses, which let people stay more present through hands-free interaction, and Meta Spark, a platform that allows creators and businesses to build augmented reality experiences that bring the digital and physical worlds together in their apps.

In general, while all these investments are part of Meta’s long-term initiative to help build the metaverse, its virtual reality and social platform efforts also include notable shorter-term projects developing specific products and services to go to market, whereas its augmented reality efforts are primarily directed toward longer-term research and development projects.

Meta Platforms Inc Reportable Segment Revenue FY2022

Meta Platforms Inc Economic Moat

Meta Platforms Inc Economic Moat

Economic Moat: Wide

There are many ways to identify Meta Platforms Inc’s economic moat, but I focus on the above 5 types. The rating is

purely subjective and based on my in-depth understanding and analysis of Meta Platforms Inc. Please check my summary to understand more about the economic moat.

Performance Checklist

Is Meta Platforms Inc’s revenue growing YoY for the past 5 years consistently? Inconsistent.

Is the net income growing YoY for the past 5 years consistently? Inconsistent.

Is the cash flow from operating activities growing YoY for the past 5 years consistently? Inconsistent.

Is the free cash flow positive for the past 5 years? Yes.

Is the gross margin % consistent/ growing for the past 5 years? No.

Is the EPS growing for the past 5 years? Inconsistent.

Meta Platforms Inc Revenue, Net Income, Operating Cash Flow, and FCF (USD Million)

Is the free cash flow per share growing for the past 5 years? Inconsistent.

Meta Platforms Inc FCF per Share

Management Effectiveness

Is Meta Platforms Inc’s ROE consistently at 12%-15% YoY for the past 5 years? Yes.

Meta Platforms Inc Return on Equity

Is the ROIC consistently at 12%-15% YoY for the past 5 years? Yes.

Meta Platforms Inc Return on Invested Capital vs Weighted Average Cost of Capital

The trendline for the number of shares outstanding is declining, which is something that an investor would be pleased to see.

Meta Platforms Inc Shares Outstanding (Million Shares)

Meta Platforms Inc Financial Health

Meta Platforms Inc Financial Health (USD Million)

Current Ratio: 2.2 (pass my requirement of >1.0)

Debt-to-EBITA: 0.7 (pass my requirement of <3.0)

Interest Coverage: N/A (pass my requirement of >3.0)

Debt Servicing Ratio: 0.0% (pass my requirement of <30.0%)

Dividend

Current Dividend yield: The company has not reported any recent payouts.

Meta Platforms Inc Valuation

Estimated intrinsic value: $212.66

Value is calculated using discounted cash flow method (taking into account their cash and debt) and scenario planning.

Average free cash flow used: USD$25,000M

Projected growth rate: 9% - 11%

Beta: 1.18

Discount rate: 8.4%

Date of calculation: 20 Mar 2023

Free cash flow used is a weighted average that is rounded to the nearest tens. In some instances, I used a more realistic number to represent the free cash flow.

Total debt and cash and short-term investments are last quarter figures that are rounded to the nearest tens. In some instances, I used more realistic numbers to represent them.

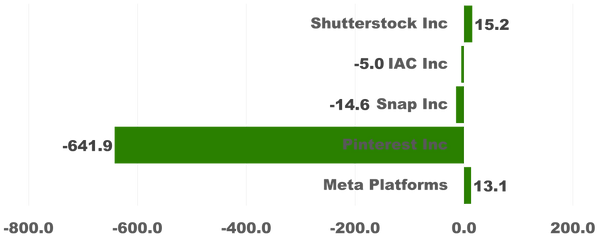

Meta Platforms Inc EV-to-EBITA vs its peers

Meta Platforms Inc Price-Earnings Ratio vs its peers

Meta Platforms Inc Historical Price-Earnings Ratio

Additional Resources

I recommend reading University of Berkshire Hathaway as it greatly helps in my stock analysis. If you want a complete collection of recommended books, please visit here.

My Top Concern

One of the concerns that I have for Meta is that its revenue is substantially generated from advertising. The loss of marketers, or reduction in spending by marketers, could harm their business.

Marketers do not have long-term commitments and spend only a small portion of their advertising budgets on Facebook. If Facebook does not deliver ads effectively or provide a competitive return on investment, marketers may reduce their budgets or stop doing business with Facebook altogether. If the demand for Facebook's ads decreases, the company's revenue could be negatively affected.

In addition, most of the revenue comes from advertising on mobile devices, but they are dependent on the interoperability of their products with popular mobile operating systems, networks, and products that Meta does not control, such as Android and iOS. Any changes or technical issues in these systems or even changes in their relationships with these mobile operating system partners could hurt Meta’s business.

The next concern involves the competitive landscape that Meta operates in.

The success of Meta relies on adding, retaining, and engaging active users, particularly for Facebook and Instagram. Any decline in user retention, growth, and engagement could impact the company's revenue-generating potential. Meta must maintain and increase levels of user engagement and monetisation to grow revenue, and failure to do so could render its products less attractive to users, marketers, and developers, which could affect its business.

The company also faces significant competition in every aspect of its business, including from companies that provide online products and services, sell advertising, or develop tools for managing and optimising advertising campaigns. The competition is particularly strong in attracting and retaining users, businesses, and developers. Meta may also face challenges from competitors who develop products, features, or services that are similar to its own or that achieve greater acceptance, or who adopt more aggressive pricing policies. While Meta may take actions to respond to competitive threats, there is no guarantee that these actions will be successful.

Lastly, Meta is subjected to various laws and regulations, both foreign and domestic, related to privacy, data protection, intellectual property, advertising, and taxation. The constantly evolving and uncertain nature of these laws and regulations, as well as the potential for private parties to enforce them, could have an impact on the company's financial results. There are also ongoing investigations and lawsuits in various jurisdictions regarding WhatsApp's terms of service and privacy policy, which could affect the company's ability to transfer data among its products and services and target ads. All these factors may increase the cost of operations, decline user growth or engagement, or otherwise harm Meta’s business.

Summary for Meta Platforms Inc

I rate Meta Platform a wide economic moat based on its intangible assets, network effect and a little bit of switching cost.

Intangible assets do not always relate to branding. For Meta, its intangible assets stem from its massive user data. Meta has a competitive advantage over other platforms as it has accumulated extensive data on its users' demographic information, interests, browsing history, and billions of uploaded photos and videos. This allows Meta to offer highly relevant content to its users, and it enhances the value of its data asset, which only Meta and its advertising partners can monetise.

Meta's possession of data about each of its 2.5 billion monthly active users creates unique advertising opportunities. Meta uses this information to improve its advertisers' ads, enabling advertisers to post more effective ads, leading to a higher return on investment. This attracts more advertisers to the platform, allowing Meta to continue monetising its network. The value of this data is shown by the rapid growth of Meta's average ad revenue per user over the past five years, indicating the high prices advertisers are willing to pay for ad placement on the platform.

Meta's expansion into the mobile market has led to an increase in ad revenue growth, driven by the growing mobile and video ad markets. The majority of Meta's users access the platform via mobile devices, with WhatsApp being the most popular app worldwide. Although previous attempts to monetise WhatsApp were unsuccessful, Meta is now offering businesses a platform to showcase their products and services and provide customer support through WhatsApp Business.

While the regulation and enforcement of antitrust laws could potentially threaten Meta's intangible assets, specifically its data, any restrictions on data access and usage would affect all companies, not just Meta.

Besides Meta’s intangible assets, the company’s dominance in the social media market, through its various platforms including Facebook, Instagram, Messenger, and WhatsApp, has strengthened the network effect. This means that as more people join and use these platforms, they become more valuable to users. Additional features on the Meta platform help keep users within the ecosystem. These network effects create barriers to entry for new social networks, as well as barriers to exit for existing users who may lose connections, pictures, and memories if they switch to other platforms.

Meta also benefits from a reasonable switching cost, as leaving the platform could cause some friction for users due to the potential loss of data, contacts, and interaction with other users. While it is easy to sign up for alternative platforms, users may be reluctant to leave Meta's platforms. Despite many users accessing multiple social networks per day, this does not seem to negatively impact Meta's overall ecosystem.

Meta has had an unpredictable financial performance over the past five years. While revenue, net income, and operating cash flow have shown inconsistency, Meta has managed to maintain positive free cash flow during this period. However, the company has seen a decline in both gross and net margins, indicating potential challenges in maintaining profitability. Despite this, both margins are still above the industry average, suggesting that Meta is still performing relatively well compared to its peers.

Meta has consistently maintained its ROE and ROIC of about 15% over the past 5 years. This is an impressive feat, as it demonstrates the company's ability to generate significant profits on the money it has invested. Meta's ROE is twice the industry average, indicating that the company is doing a better job of using shareholder equity to generate profits than its competitors. Additionally, Meta's ROIC is twice its WACC, which means that the company is earning more on its investments than the cost of capital. This is a positive sign for investors, as it suggests that Meta is allocating its capital efficiently.

Meta is in a strong financial position with a healthy balance sheet. The company has passed all four of my debt requirements, indicating that it has the sufficient operating cash flow to cover its debt obligations. This means that Meta's financial health is not at risk from its debt. The coverage of interest payments is not a concern. Although the current ratio has declined, it is still above the industry average, indicating that Meta can meet its short-term financial obligations. Additionally, Meta's short-term assets exceed its long-term liabilities, which indicates that the company has a solid liquidity position to support its long-term growth.

Even though Meta is a wide economic moat company with impressive capital allocation and balance sheet, I will still plan to give a margin of safety of 25% when investing in Meta. This approach would provide a cushion against any unexpected events. The estimated intrinsic value of Meta is $212.66, and after factoring in the margin of safety, the investment range would be around $160.

Please help us report any inaccurate information here. Thank you.